Averaging Trading Strategy

Being a trader in financial marketing is not an easy occupation, since financial market be a magnet for businessman both beginner and expert. It draws many competitors in this field. Trading forex (foreign exchange)is a branch of business in financial market; this business includes buying, selling and exchange foreign currencies.

If you are interested to join this business, you have to know strategies of forex trading first. Averaging, scalping forex and price action trading strategy are some strategy that trader use to get their financial target; averaging trading strategy is an older strategy in forex trading that trader takes to minimize loss and it also prevents traders go bankrupt, scalping forex trading strategy is strategy that traders use to get a scalping opportunity and in the forex market, price action trading strategy is strategy in trading while all significant decisions are taken based on simplest or real price charts.

Cost averaging strategy is an example of averaging trading strategy, this strategy was applied by German pensioner Ingeborg Mootz, he is a master trader in financial marketing. This strategy seems primitive for some people but it is still helpful like other trading strategy that is popular in financial marketing. For example, you buy certain currency in $1, then the price gets lower $ 0.8 for example, you still buy that currency and when the price goes higher ($1.2), you sell it. You still get profit even it is not much.

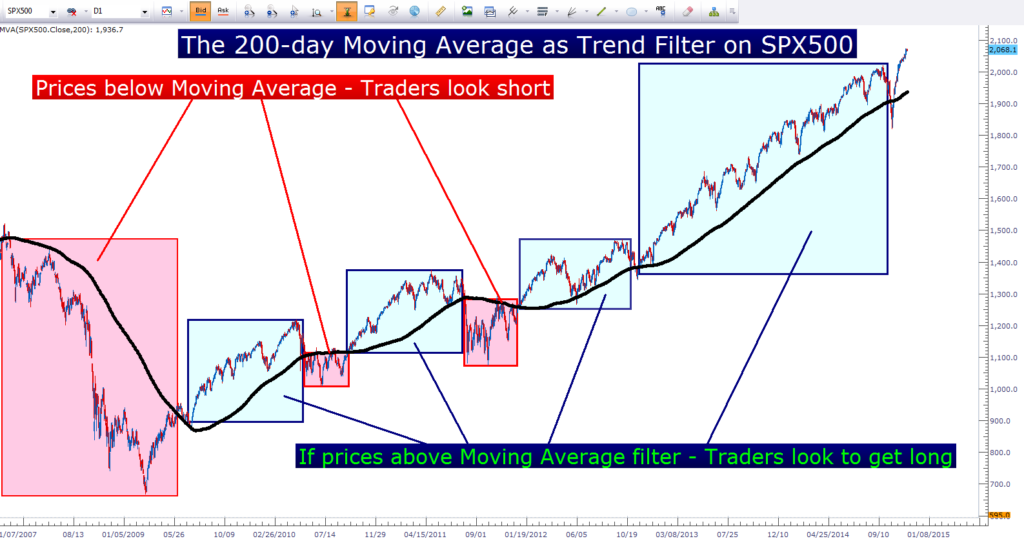

Trading forex is perilous because the change of price cannot be predicted easily. However, you cannot predict the price of currency changed, you still can analyze next possible price by analyzing the chart of price before. Analyzing market is significant before you execute your account. There are three ways of analyzing market; the first is technical analysis, this technique involves evaluating chart or chronological data in the past to predict how the currency progress in the next time. The second is fundamental analysis; this technique involves the actual situation of country’s economy or economic fundamental that gives traders information to decide when the right time to execute. The last technique is sentiment analysis, this technique is subjective and involves mood of the market, analyze mood of market help trader in making decision. Those are based techniques that traders use in analyzing market before execution.

Scalping Forex Trading Strategy

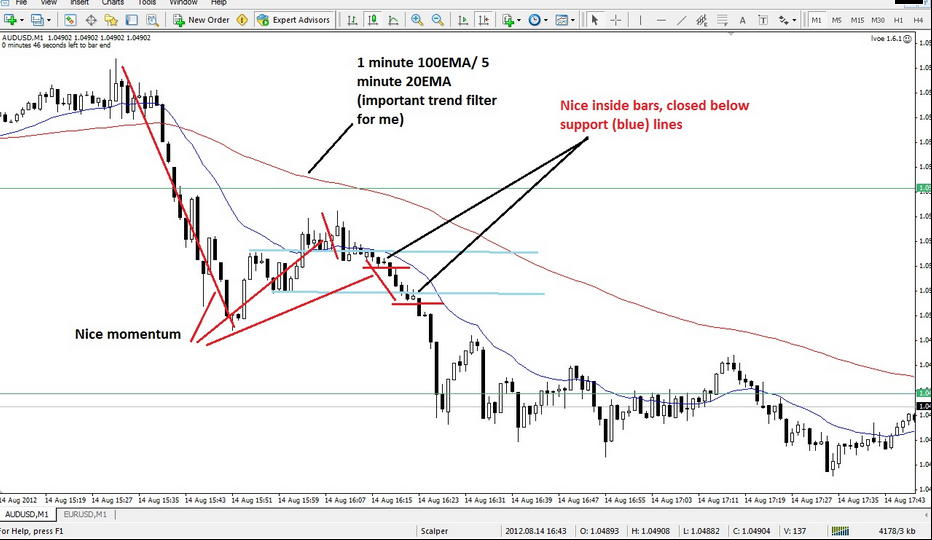

Then, scalping forex trading strategy that you have to know are basic strategy, simple strategy, complex strategy and advance strategy. Each strategy have its features and you can choose whether you use simple or other strategy after you comprehend the four strategies’ features. The first is basic strategy; fast moving average crossover, slow moving average crossover, 28-100 MA trading, stochastic high-low, RSI high-low, stochastic line crossover, double stochastic, simple MACD crossover, the “stupid guy” system, EMA breakthrough, My Line In The Sand, trend line tunnel, H4 Bollinger Band Strategy, GBP/USD breakouts, 3 white soldiers/ 3 black crows, the fractal guru strategy, ADX power, trend line simple trading, picking tops and bottoms on Bollinger band, trading off the daily chart, hedging strategy with two brokers using roll over free account. Those simple strategies fit for beginner because no need to analyze market intensely. Then, simple balanced system, SFT simple strategy, parabolic SAR+ADX, EUR/USD simple system are example of simple strategy in trading forex. Next, complex strategy such as “multi conditional” and “two cross” are strategies for traders who have experience in this field because it needs skill to apply those strategies. The last, advance strategy that used by expert in trading forex such as “midnight set up” and “Fibonacci trading” strategy.

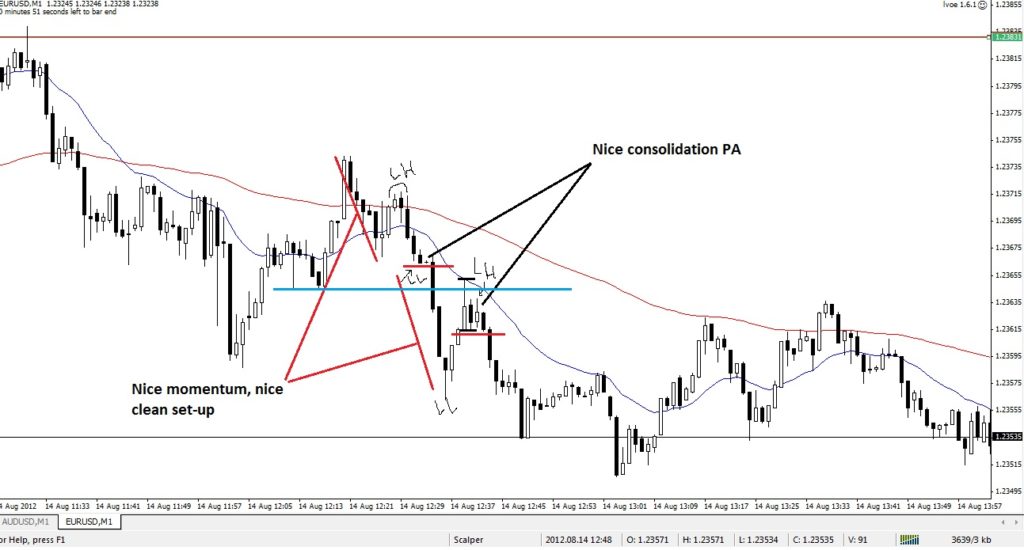

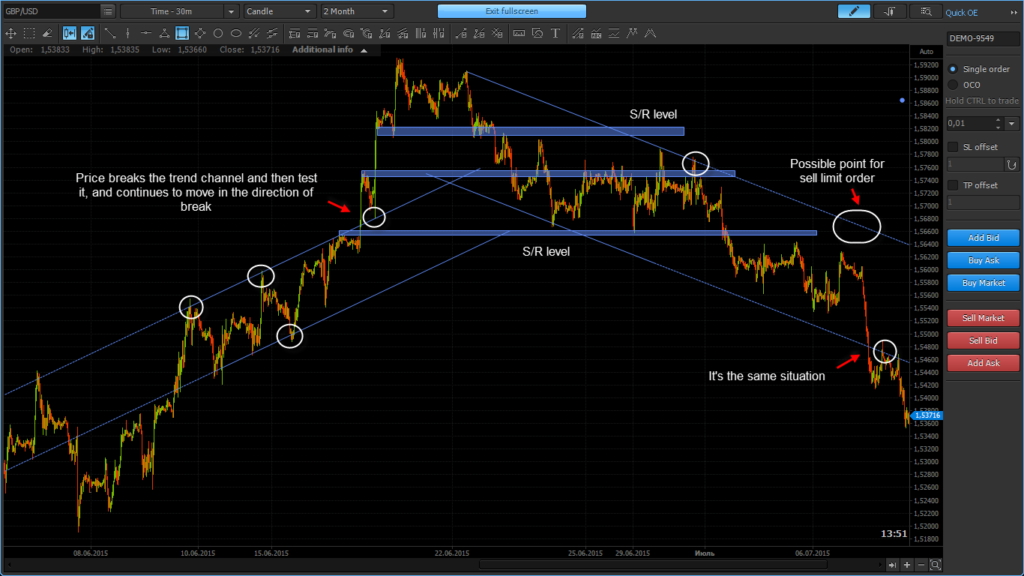

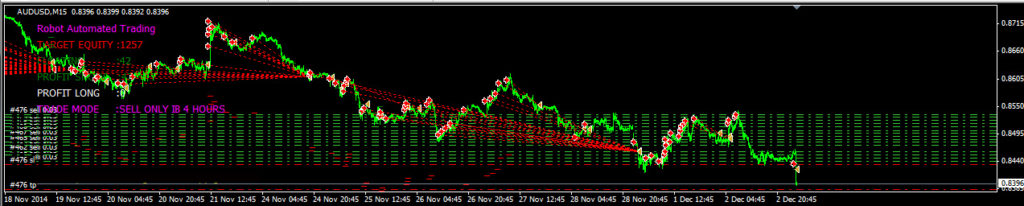

My suggestion if you’re using scalping strategy with price action find break out of support resistance based reversal candlestick patterns on m15-h1 time frame then wait for pull back then we go open trade but remember this method still need confirmation from major trend or wave trend on big time frame from daily. Example : if daily confirm down trend then we only looking for sell with waiting for break support on m15-h1. We can use valid order block on small time frame to marking as our entry zone.

Price action trading strategy is a simple strategy that can be used by beginner because it’s simple. This strategy requires a record of past chart market. It is because this strategy is analyzing what happened in the past to predict what will happen next. But it does not means that the prediction will be right, since price is not influenced by a single factor, traders will not can predict price completely but at least traders know the habit of chart to calculate the next price. Candlestick- price action is the simple form of price action strategy, traders just need to look up candlestick chart in the past event and calculate it as consideration before making a decision. Those are strategies that most traders apply when they are trading forex, you can choose one of them as your strategy.

Wanna Trade Like Professional Using Smart Money Concept Entry Confirmation Strategies ?