Among the automated systems for trading are Forex Expert Advisors. Do you know what Forex Expert Advisors are? If you don’t know about them yet, don’t worry. In this article, we will explain what Forex Expert Advisors are, types, their functions, what you should know, advantages, disadvantages, testing, and research. These should help you better understand about forex automation.

What Are Forex Expert Advisors?

Before we go further down explaining automated trading systems, let’s get to know what forex expert advisors actually are. What are these forex expert advisors? They are automated trading systems whose role is to generate trading signals as well as notify a trader of opportunities that are present in the market.

Forex expert advisors, being automated trading software, are based on certain preset rules. These rules, however, may vary between one advisor and another. This is amazing. Not only such software helps you to decide without being dictated by emotions, but they also are customizable as you can set the preset rules to maximize your trade.

When it comes to forex automation, there are also the forex robots that work quite similarly to the forex expert advisors. What makes the two different? The forex robots are able to trade on behalf of the trader automatically. Forex expert advisors, on the other hand, can’t do so without being authorized by a trader to do so.

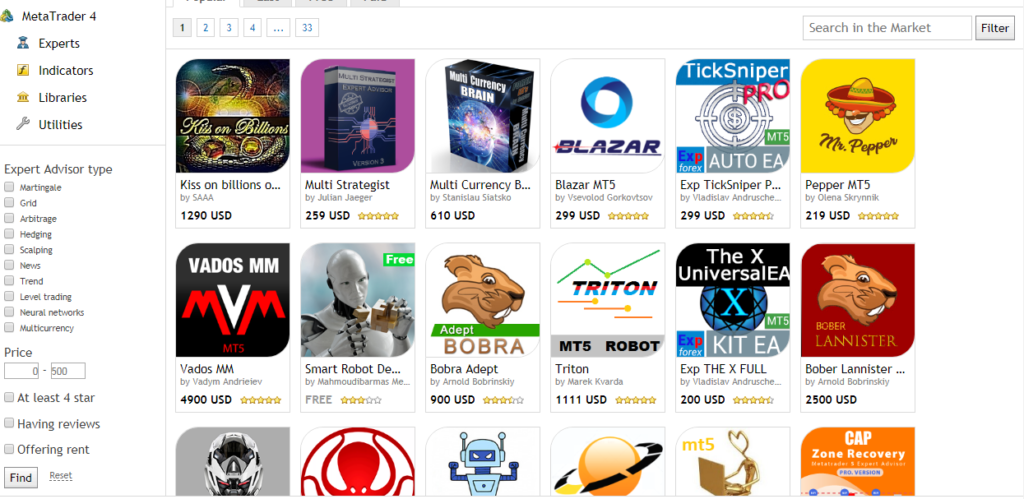

You might wonder where you can get forex expert advisors. Well, you can get them easily on the internet. The software usually sold for a price. After purchase, you can install it on the trading platform immediately. No special technical knowledge is required. It is very simple and helpful for a trade’s trading routine.

Types Of Forex EA

There are four types of forex expert advisors: copy trade forex ea, price action forex ea, averaging forex ea, martingale forex ea, breakout expert advisor, news expert advisor, scalping forex expert advisor, and hedge expert advisor. The followings are brief overviews of each type.

Breakout Expert Advisor

The breakout expert advisor is specifically made to open a trade once price breaks through the support and resistance levels that have been preliminary determined beforehand.

News Expert Advisor

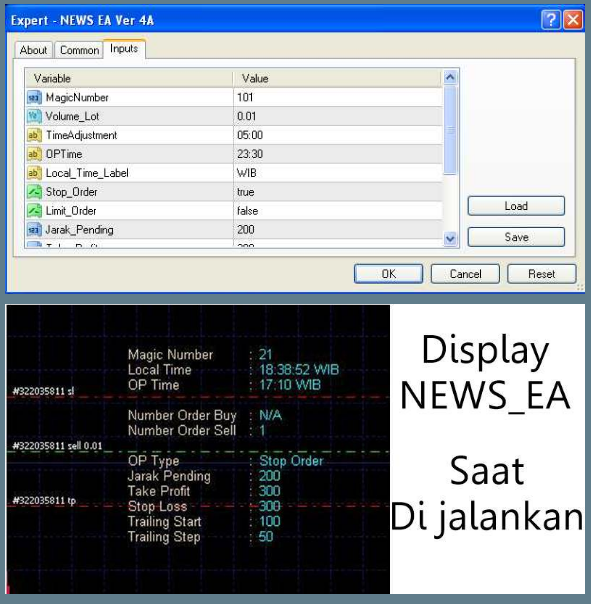

This news forex ea usually use when big price movements or only in news events like fomc statement, non farm payroll and any big economics news that give big effect to market volatile.

This EA functions to open a Pending Order Buy & Sell together at a certain time that we specify.

This EA is usually used when going out News (Economy News) The selected Pending Order can be a Stop Order (Buy Stop & Sell Stop) or Limit Order (Buy Limit & Sell Limit)

After one pending order is executed, the others will be deleted automatically. The order can be immediately given a Stop Loss, Take Profit or Trailing Stop whose value is determined in the input.

Scalping Forex Expert Advisor

The expert advisor scalper helps you to secure small profits when they are available. The automated trading software will open and close a huge number of trades (up to 400 to 500 per day, depending on the conditions of the market) for profit.

Hedge Expert Advisor

This hedging forex expert advisor works in two ways: facilitating profits and diminishing losses.

Hedging is done by buying and selling of one and the same asset simultaneously, or on several different assets but the price movements are interrelated. Usually well done in micro and cents account with 1:500 or 1:1000 laverage.

Functions

The beauty of forex expert advisors is that they can be programmed to work in certain ways a trader wants. For example, searching for breakouts and important trends, applying technical indicators like moving average indicator or moving average convergence/divergence indicator and even using Algorithm from reversal candlestick patterns The systems will then use these indicators, analyze the market, and give a signal regarding trading opportunities.

Earlier we said that forex expert advisors are different from forex robots. On one hand, forex expert advisors give a signal for trade opportunities. On the other, forex robots do the trades, no manual sign-off required. Keep in mind that we meant it generally. There are exceptions that blur the lines between the two.

Some forex expert advisors are specifically made to take full control of a trader’s account. The main idea in these kinds of systems is that the systems will look at a trader’s current balance, which will then be used to determine the amount of the balance that is safe enough to put at risk.

There are some forex expert advisors that review the trades and decide the next action that should be taken. Indeed, the forex automation decides whether the next action should be a stop-loss, take-profit or trailing stop. Once the systems obtained the necessary details, they will consider the dominating market conditions. They then notify you when to open a certain position.

Things to Know Before Launching Your Own Forex Expert Advisors

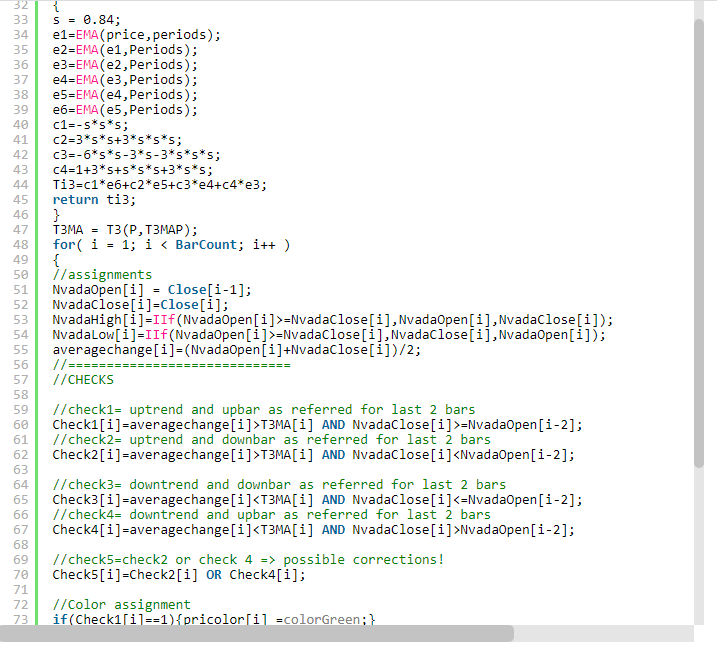

What if you can’t forex expert advisors that suit your trading routines? There is nothing to worry about. Remember, there is always an option to create your own automatic trading systems. Before you launch your own systems, there are several things that you should know first. Here they are.

Data is important

Keep in mind the importance of data. Back testing results aren’t that reliable. Even if the systems yield such great results, that doesn’t necessarily mean the systems are ready to prosper. Why? Because the results depend on the data quality being used in the back-test. Fortunately, there are lots of available data and how to prepare it for the systems.

Execution speed

Getting reliable data is the first step. The next one is to understand the execution speed. This becomes a problem if you use free forex expert advisors, which demand trading activity for over 30 seconds. If there isn’t any activity, the systems will time out. You will then have to re-authenticate your systems, which might take up to two seconds.

Debugging

Debugging the code is important but it is difficult. Worse yet, there might not be a debugger in your systems as they are more catered to brokers’ needs than traders’. Fortunately, there are things you can do to do the debugging. For example, you can use Microsoft Debug View or input the print functions into the code directly.

MetaTrader connection

Lastly, test the MetaTrader connection. The systems must be not just turned on but also connected to the brokers to run the forex expert advisors. There are some that have automatic reconnect feature but it isn’t that reliable. So, always test the MetaTrader connection.

Advantages and Disadvantages

Each and every strategy in forex trading has its own advantages and disadvantages. Of course, that also includes automated trading systems as well. As good as they might seem, forex expert advisors too have advantages and disadvantages. Knowing both the advantages and disadvantages of them should give you a better perspective, allowing you to decide whether or not to use them.

Advantages

The forex markets are always open, twenty-four hours a day seven days a week. No traders can stay on the market for that long. Fortunately, forex automation like forex expert advisors can fill in when the traders are absent. This means you can make the best out of trading opportunities even when you are occupied.

There is also the emotional factor. No matter whether a trader is a beginner or a pro, there is always an emotional factor. And this can prove fatal for trading decisions as emotions like greed and fear can cloud judgment. Forex expert advisors aren’t affected by any emotional factor and carry out the trade based on the instructions the trader gave.

Another advantage is reduced mental and emotional exhaustion and stress levels. Forex trading is a time-consuming enterprise. This is particularly true if your main income source comes from forex trading. Although forex expert advisors, being automated trading systems, don’t lift your burden entirely, they help to make the burden lighter.

Disadvantages

What about the disadvantages? Forex expert advisors, being automated trading systems, are unable to respond properly to real-time news as they would not consider important fundamental motivations to make or not to make trades. If you yourself monitor the news at your desk, these trading mistakes can be avoided easily.

There is also the fact that forex expert advisors are limited to act according to what instructions the trader has given them. Yes, forex expert advisor systems can process more variables than human traders can. However, their actions are limited. Human traders, on the other hand, are not that rigid.

Testing and Research

There is no such thing as the best automated forex trading software ever. There is only forex trading software that suits a trader’s trading routines. And even then a trader must test and do their own research to get the most suitable forex expert advisors for their trading routines.

At least if we using automated forex software got from professional source like mql5.com. Or from professional forex traders that using their manual forex strategy that works and converting their manual strategy in to automated forex strategy.

If the forex expert advisors are programmed, you need to check and change the variables over time. Why? Because the trends in the market are always changing and the systems should keep up with the changes.

If the forex expert advisors are from another individual or firm, you need to be very careful as the currency market is mostly unregulated. This gives an opportunity for scammers to do their bidding. Be wary of those creators who give a promise of unrealistic high returns.

Forex expert advisors do look good on papers. That being said, you still need to do some testing and research if you want to find the most suitable automated trading systems for your trading routines. There is no way around that. Yes, it takes time but it will surely worth the effort.